What I Learned Losing a Million Dollars

Ratings/reviews counts are updated frequently.

Check link for latest rating. ( 5,292 ratings, 372 reviews)Read More

Found a better price? Request a price match

What I Learned Losing a Million Dollars

Book Hero Magic created this recommendation. While it's new and still learning, it may not be perfect - your feedback is welcome! IS THIS YOUR NEXT READ?

What I Learned Losing a Million Dollars

What I Learned Losing a Million Dollars is more than just an exploration of financial markets; it is a profound journey into the psychological intricacies of decision-making under pressure. Presented through the gripping and candid narrative of Jim Paul, a once-successful trader, the book delves into the sequence of events that led to his extraordinary rise and dramatic fall. Starting from a humble background in Northern Kentucky, Paul's remarkable ascent saw him becoming a governor of the Chicago Mercantile Exchange. However, his journey took a perilous turn as unchecked confidence and ambition culminated in a catastrophic $1.6 million loss, stripping him of his wealth, reputation, and position.

This compelling analysis, co-authored with renowned financial educator Brendan Moynihan, goes beyond the specifics of trading blunders to encompass universal lessons in risk management and personal accountability. It dissects the psychological barriers that often overshadow rational analysis, serving as an insightful guide for investors navigating the unpredictable tides of economic markets.

The book, lauded with a 2014 Axiom Business Book Award gold medal, initially chronicles Paul's winning streak, painting a vivid picture of the allure and pitfalls of success in high-stakes finance. The narrative then shifts to examine the confluence of decisions and psychological errors that precipitated his financial downfall. Through Paul's story, the authors illustrate a critical point: regardless of the multitude of strategies available for making money, losses predominantly stem from a few fundamental errors.

Paul and Moynihan provide readers with a framework for avoiding such losses, highlighting that while analytical methods bring their own set of challenges, it is the psychological dimension of investing that can lead investors astray. By presenting real-world examples and pragmatic strategies, they enable readers to identify and sidestep the emotional traps that lead to poor decision-making. This book is essential for anyone seeking to understand the fine line between calculated risk-taking and financial ruin.

What I Learned Losing a Million Dollars is not just an account of lost fortunes but a valuable resource for cultivating a mindset resilient to both market volatility and personal biases, ultimately offering a roadmap to more informed and disciplined financial decisions.

Book Hero Magic summarised reviews for this book. While it's new and still learning, it may not be perfect - your feedback is welcome! HOW HAS THIS BEEN REVIEWED?

What I Learned Losing a Million Dollars highlights the pitfalls of investing by sharing personal experiences and insights into psychological biases and mistakes. Reviewers find it an enlightening read with a unique approach that focuses on avoiding losses rather than just achieving gains. The book is praised for its value in understanding the psychological 'flaws' that lead to significant financial blunders, making it essential reading for traders and investors.

Book Details

INFORMATION

ISBN: 9780231164689

Publisher: Columbia University Press

Format: Hardback

Date Published: 30 April 2013

Country: United States

Imprint: Columbia University Press

Contributors:

- Foreword by Jack Schwager

Audience: Professional and scholarly

DIMENSIONS

Width: 140.0mm

Height: 210.0mm

Weight: 0g

Pages: 192

About the Author

Jim Paul (1943-2001) was first vice president in charge of the Morgan Stanley Dean Witter & Co. International Energy Unit in New York City. During his twenty-five-year career in the futures industry, he was a retail broker, floor trader, and research director and served on the Chicago Mercantile Exchange Board of Governors and the Executive Committee. Brendan Moynihan is a managing director at Marketfield Asset Management LLC, where his understanding of markets and the media helps shape their macro views and allocations. He is an adjunct professor of finance at Vanderbilt University's Owen Graduate School of Management. He is also the author of Financial Origami: How the Wall Street Model Broke. He lives in Barrington Hills, Illinois, with his wife and two sons. Jack Schwager is the author of the best-selling Market Wizard series as well as the three-volume Schwager on Futures. His latest work, Market Sense and Nonsense, was published in November 2012. He is currently the portfolio manager for the ADMIS Diversified Strategies Fund. His experience includes twenty-two years as director of futures research for some of Wall Street's leading firms.

More from Biography & Memoir

View allWhy buy from us?

Book Hero is not a chain store or big box retailer. We're an independent specialist on a mission to help more Kiwis rediscover a love of books and reading!

Service & Delivery

Our cozy 200m2 warehouse in Auckland holds over 10,000 books in-stock so you're not waiting for books to arrive from overseas.

Auckland Pick Ups

We're an online-only store but for your convenience you can pick up your order for free from our warehouse in Hobsonville.

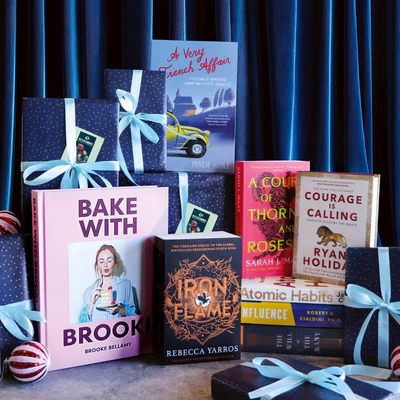

Our Gifting Service

Books make wonderful thoughtful gifts and we're here to help with gift-wrapping and cards. We can even send your gift directly to your loved one.