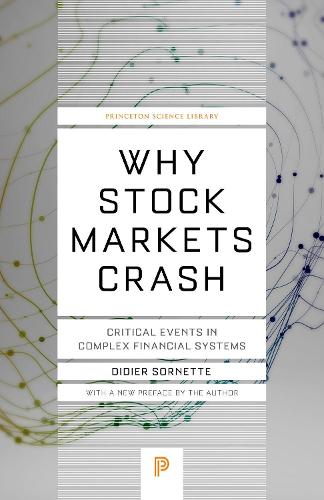

Why Stock Markets Crash

Ratings/reviews counts are updated frequently.

Check link for latest rating. ( 247 ratings, 23 reviews)Read More

Found a better price? Request a price match

Why Stock Markets Crash

Book Hero Magic created this recommendation. While it's new and still learning, it may not be perfect - your feedback is welcome! IS THIS YOUR NEXT READ?

Why Stock Markets Crash

The scientific study of complex systems has transformed a wide range of disciplines in recent years, enabling researchers in both the natural and social sciences to model and predict phenomena as diverse as earthquakes, global warming, demographic patterns, financial crises, and the failure of materials. In this book, Didier Sornette boldly applies

In Why Stock Markets Crash, Didier Sornette delves into the intricate fabric of financial markets to unravel the mysterious mechanisms behind their sudden collapses. Departing from conventional theories that focus on immediate triggers, Sornette's groundbreaking work suggests a deeper, more complex process underpinning the inception of financial crises. He posits that these catastrophic events stem from a gradual build-up of speculative momentum—what he terms "bubbles"—that can evolve over months or even years before leading to the eventual crash.

Through the lens of advanced physical and statistical modelling techniques, Sornette invites readers on a compelling journey that unveils the hidden symmetries and patterns lurking within market behaviours. His theory illuminates the concept of cooperative speculation, highlighting how collective investor psychology can drive markets into periods of accelerated growth, ultimately sowing the seeds of their demise.

Why Stock Markets Crash embarks on an analytical journey through history, examining landmark cases of financial hysteria. From the 'tulip mania' in 17th-century Netherlands and the notorious South Sea Bubble of 1720, to the harrowing declines of October 1929 and Black Monday in 1987, Sornette scrutinises these events and questions the sufficiency of traditional explanations. Instead, he presents a compelling argument for the role of self-organising phenomena, explaining how seemingly random fluctuations can catalyse dramatic market reversals.

Written with an eye for detail and rich with scientific accents, this book is as much a chronicle of financial disasters as it is a celebration of the scientific principles that can guide us in predicting and understanding them. Sornette's insights will intrigue not only investors and financial professionals seeking to fortify their understanding of potential market collapses, but also academics across disciplines. Physicists, geologists, biologists, economists, and others will find Why Stock Markets Crash a visionary exploration of stock market dynamics, balancing the thrill of scientific discovery with the urgent relevance of financial market stability. Engage with this illuminating narrative to appreciate why the financial crashes of the future no longer have to be mere shadows lurking in the unknown.

Series: Princeton Science Library

View allBook Hero Magic summarised reviews for this book. While it's new and still learning, it may not be perfect - your feedback is welcome! HOW HAS THIS BEEN REVIEWED?

Why Stock Markets Crash by Didier Sornette is praised for its engaging and well-researched exploration of financial markets and their complexities. Readers appreciate its accessibility, requiring no specialised knowledge, and find it enlightening across various fields like game theory and fractals. The book is recommended for both stock market enthusiasts and those interested in financial bubbles and their prediction, offering something insightful for traders with diverse strategies.

Book Details

INFORMATION

ISBN: 9780691175959

Publisher: Princeton University Press

Format: Paperback / softback

Date Published: 21 March 2017

Country: United States

Imprint: Princeton University Press

Edition: Revised edition

Illustration: 10 halftones. 155 line illus. 21 tables.

Contributors:

- Preface by Didier Sornette

Audience: Tertiary education, Professional and scholarly

DIMENSIONS

Width: 140.0mm

Height: 216.0mm

Weight: 510g

Pages: 448

About the Author

Didier Sornette is professor of entrepreneurial risks at the Swiss Federal Institute of Technology in Zurich, professor of finance at the Swiss Finance Institute in Geneva, and the director of the Financial Crisis Observatory at ETH Zurich.

More from Finance & Investment

View allWhy buy from us?

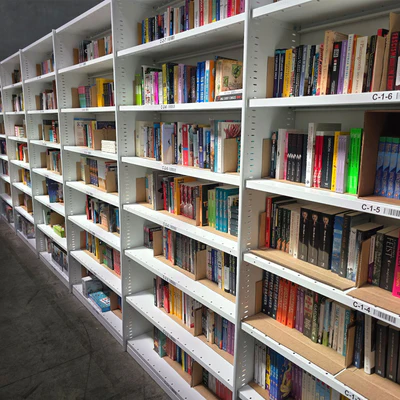

Book Hero is not a chain store or big box retailer. We're an independent specialist on a mission to help more Kiwis rediscover a love of books and reading!

Service & Delivery

Our cozy 200m2 warehouse in Auckland holds over 20,000 books in-stock so you're not waiting for books to arrive from overseas.

Auckland Pick Ups

We're an online-only store but for your convenience you can pick up your order for free from our warehouse in Hobsonville.

Our Gifting Service

Books make wonderful thoughtful gifts and we're here to help with gift-wrapping and cards. We can even send your gift directly to your loved one.