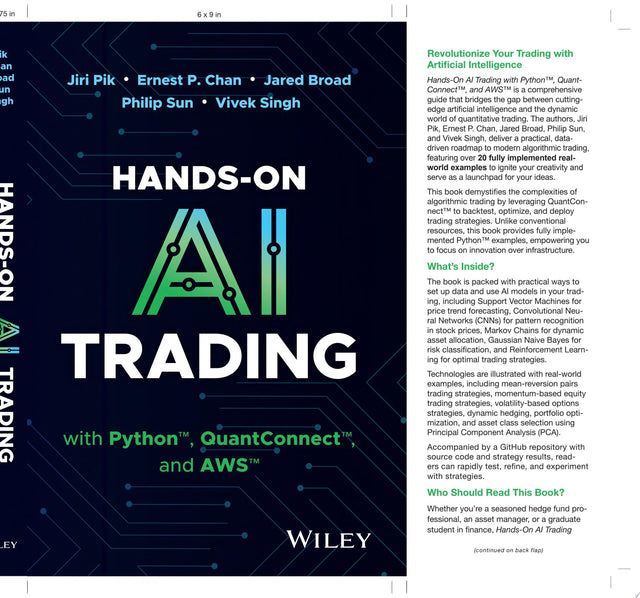

Hands-On AI Trading with Python, QuantConnect, and AWS

Found a better price? Request a price match

Hands-On AI Trading with Python, QuantConnect, and AWS

Hands-On AI Trading with Python, QuantConnect, and AWS

Master the art of AI-driven algorithmic trading strategies through hands-on examples, in-depth insights, and step-by-step guidance.

Hands-On AI Trading with Python, QuantConnect, and AWS explores real-world applications of AI technologies in algorithmic trading. It provides practical examples with complete code, allowing readers to understand and expand their AI toolbelt.

Unlike other books, this one focuses on designing actual trading strategies rather than setting up backtesting infrastructure. It utilises QuantConnect, providing access to key market data from Algoseek and others. Examples are available on the book's GitHub repository, written in Python, and include performance tearsheets or research Jupyter notebooks.

The book starts with an overview of financial trading and QuantConnect's platform, organised by AI technology used:

- Examples include constructing portfolios with regression models, predicting dividend yields, and safeguarding against market volatility using machine learning packages like SKLearn and MLFinLab.

- Use principal component analysis to reduce model features, identify pairs for trading, and run statistical arbitrage with packages like LightGBM.

- Predict market volatility regimes and allocate funds accordingly.

- Predict daily returns of tech stocks using classifiers.

- Forecast Forex pairs' future prices using Support Vector Machines and wavelets.

- Predict trading day momentum or reversion risk using TensorFlow and temporal CNNs.

- Apply large language models (LLMs) for stock research analysis, including prompt engineering and building RAG applications.

- Perform sentiment analysis on real-time news feeds and train time-series forecasting models for portfolio optimisation.

- Better Hedging by Reinforcement Learning and AI: Implement reinforcement learning models for hedging options and derivatives with PyTorch.

- AI for Risk Management and Optimisation: Use corrective AI and conditional portfolio optimisation techniques for risk management and capital allocation.

Written by domain experts, including Jiri Pik, Ernest Chan, Philip Sun, Vivek Singh, and Jared Broad, this book is essential for hedge fund professionals, traders, asset managers, and finance students. Integrate AI into your next algorithmic trading strategy with Hands-On AI Trading with Python, QuantConnect, and AWS.

Book Details

INFORMATION

ISBN: 9781394268436

Publisher: John Wiley & Sons Inc

Format: Hardback

Date Published: 18 February 2025

Country: United States

Imprint: John Wiley & Sons Inc

Audience: Professional and scholarly

DIMENSIONS

Spine width: 23.0mm

Width: 180.0mm

Height: 254.0mm

Weight: 998g

Pages: 416

About the Author

JIRI PIK: Founder and CEO of RocketEdge.com. A software architect and cloud computing expert, Jiri Pik specializes in designing high-performance trading systems. He has decades of experience in financial technologies and has worked with some of the world’s leading financial institutions, including Goldman Sachs and JPMorgan Chase.

ERNEST P. CHAN: A pioneer in applying machine learning to quantitative trading, Ernest P. Chan founded Predictnow.ai and QTS Capital Management. He is author of books such as Quantitative Trading and Machine Trading.

JARED BROAD: Founder and CEO of QuantConnect™, Jared Broad has empowered over 300,000 algorithmic traders worldwide with a platform that simplifies strategy design, backtesting, and live deployment.

PHILIP SUN: CEO and Co-founder of Adaptive Investment Solutions, LLC, and a seasoned quantitative fund manager, Philip Sun and his team focus on building state-of-the-art AI-driven risk management platform for wealth advisors and institutional investors.

VIVEK SINGH: A product leader at Amazon Web Services (AWS), Vivek Singh spearheads the development of large language models (LLMs) and Generative AI applications, bringing cutting-edge AI technologies to the trading domain.

Also by Ernest P. Chan

View allMore from Finance & Investment

View allWhy buy from us?

Book Hero is not a chain store or big box retailer. We're an independent 100% NZ-owned business on a mission to help more Kiwis rediscover a love of books and reading!

Service & Delivery

Our warehouse in Auckland holds over 80,000 books and puzzles in-stock so you're not waiting for your order to arrive from overseas.

Auckland Bookstore

We're primarily an online store, but for your convenience you can pick up your order for free from our bookstore, which is right next door to our warehouse in Hobsonville.

Our Gifting Service

Books make wonderful thoughtful gifts and we're here to help with gift-wrapping and cards. We can even send your gift directly to your loved one.